ALLAHABAD BANK

- As per previous report published on Allahabad bank stock failed to closed above its range bound zone @ 126 , stock gave some intraday move and fell down after that and still on down move and so far made a low @ 112.50. (Click here to see previous report published on Allahabad Bank).

- Now current chart indicates that stock is facing strong golden ratio support around 112 , once stock closes below 112 and stays below then further weakness is expecting for next few trading days.

- Intraday stock tips , close watch once Allahabad Bank starts trading below 112 during trading hours, and if holds below with volumes then intraday weakess is expecting.

- As per graph no2, stock is moving in a range bound zone, once stock comes out from its range then sharp move is expecting, Technical chart also indicates that stock is trading below 100 days moving average, as long as stock holds below it will be favored by bears, once stock starts trading above 100 DMA it will shown first sign of strength. Chart also indicates that stock earlier made a false bullish breakout, but failed to close above.

- Suggested Article - NSE trading and clearing holidays for year 2014.

- As per graph no 3, once stock closes below its recent bottom @ 112 and starts trading below then will find next strong support around 103 its 161.8% fibonacci retracement.

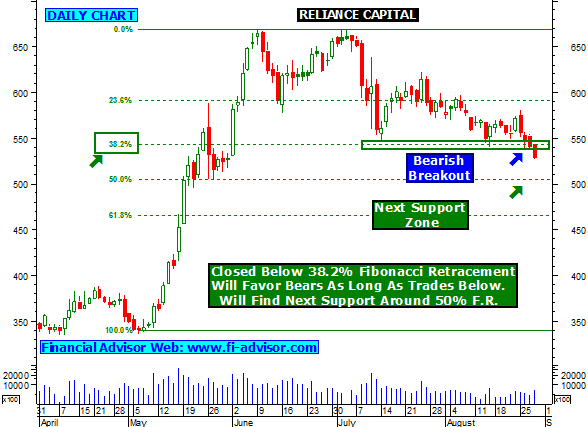

- Suggested Reading - RELIANCE CAPITAL trading below its major support, further weakness is expecting.

- As per graph no4, stock is now trading below is long bullish trend line support , by this stock made a bearish breakout and its now showing a sign of weakness.

- Click here to see all the free trading reports (tips) published by us on ALLAHABAD BANK.

- Free tips on share.