- DIVIS LABS heading for strong support around 1300 as shown in chart above.

- Stock also trading below 20 weeks moving average support, indicates will favor divis labs bears.

- Close watch if closes below 1300 in a weekly chart then bears to have upper hand in stock and can move the price further down.

- Stock will face lower bollinger band support around 1250 in weekly chart.

- Visit article from our collection - List of nse holidays for year 2014.

We at Tips On Share Blogspot provides free stock tips on US stock market like NASDAQ, Dow Jones, S&P 500 and Indian Stock Market. Free Intraday tips Stock tips and share price chart on almost every stocks of India and on New York stock exchange. We daily update Stock Tips with the help of Technical Analysis. We also provide technical analysis chart on Forex, Indian currency, mcx, ncdex and us stock market listed companies and Companies of India with outlook for today and tomorrow.

Advertisement

DIVIS LABS heading for strong support around 1300. Dated:16th May 2014 (Friday).

TTK HEALTHCARE breakout with volumes, Dated:16th May 2014 (Friday).

- TTK HEALTHCARE closes above its strong trend line resistance @ 570, with long bullish candle and with volumes.

- Stock also moving above from 200 moving average, indicates stock will favor bulls.

- On upper side stock will now test its next trend line resistance around 650.

- Article from our collections, visit link - What is sensex in Bombay stock exchange.

TATA POWER on the verge of breakout above 88.50. Dated:16th May 2014 (Friday).

- TATA POWER facing strong trend line resistance around 88.50.

- Chart indicated once starts trading above 88.50 with volumes then stock will test next trend line resistance around 92.50, 95.

- Visit article from our collection - What is stock exchange

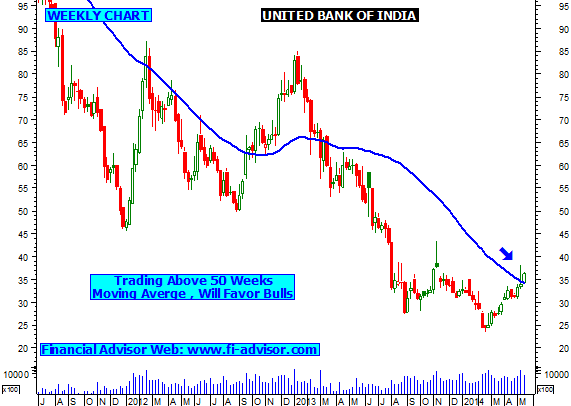

Another Banking Stock To Catch Fire - UNITED BANK OF INDIA above 38. Dated:15th May 2014 (Thursday).

- UNITED BANK OF INDIA facing strong 1st fibonacci retracement around 38.50,

- Stock Also trading above its 50 weeks moving average , as long as sustains above its 50 weeks moving average will favor united bank of india bulls.

- In daily charts stock is facing trend line resistance around 38.

- Close Watch once start trading above 38 with volume then can see bulls to get active in united bank of india and stock can move further up.

Subscribe to:

Comments (Atom)

Advertisement

What is Intraday Tips ?

Q. What is Intraday Tips / Inraday Trading / Delivery trading.

A. There are basically two types of trading on stock market--

1- Delivery

2- Intraday

Delivery trading is one in which shares are bought and can only be sold after they are delivered by the broker.that means that they cannot be sold the same day , and delivery takes two to three days after they are bought and then they are ready to be sold.

Intraday trading which takes place for that very particular day and there is no delivery..they can be bought and sold the same day...and are automatically sold at the end of the trading session if you have not sold it by yourself during the trading session. The person who suggest such types of forecast is called

A. There are basically two types of trading on stock market--

1- Delivery

2- Intraday

Delivery trading is one in which shares are bought and can only be sold after they are delivered by the broker.that means that they cannot be sold the same day , and delivery takes two to three days after they are bought and then they are ready to be sold.

Intraday trading which takes place for that very particular day and there is no delivery..they can be bought and sold the same day...and are automatically sold at the end of the trading session if you have not sold it by yourself during the trading session. The person who suggest such types of forecast is called